Our financial advisors in Farmington, Connecticut, work with families and businesses to help them work towards their financial and life goals by crafting effective personalized financial plans.

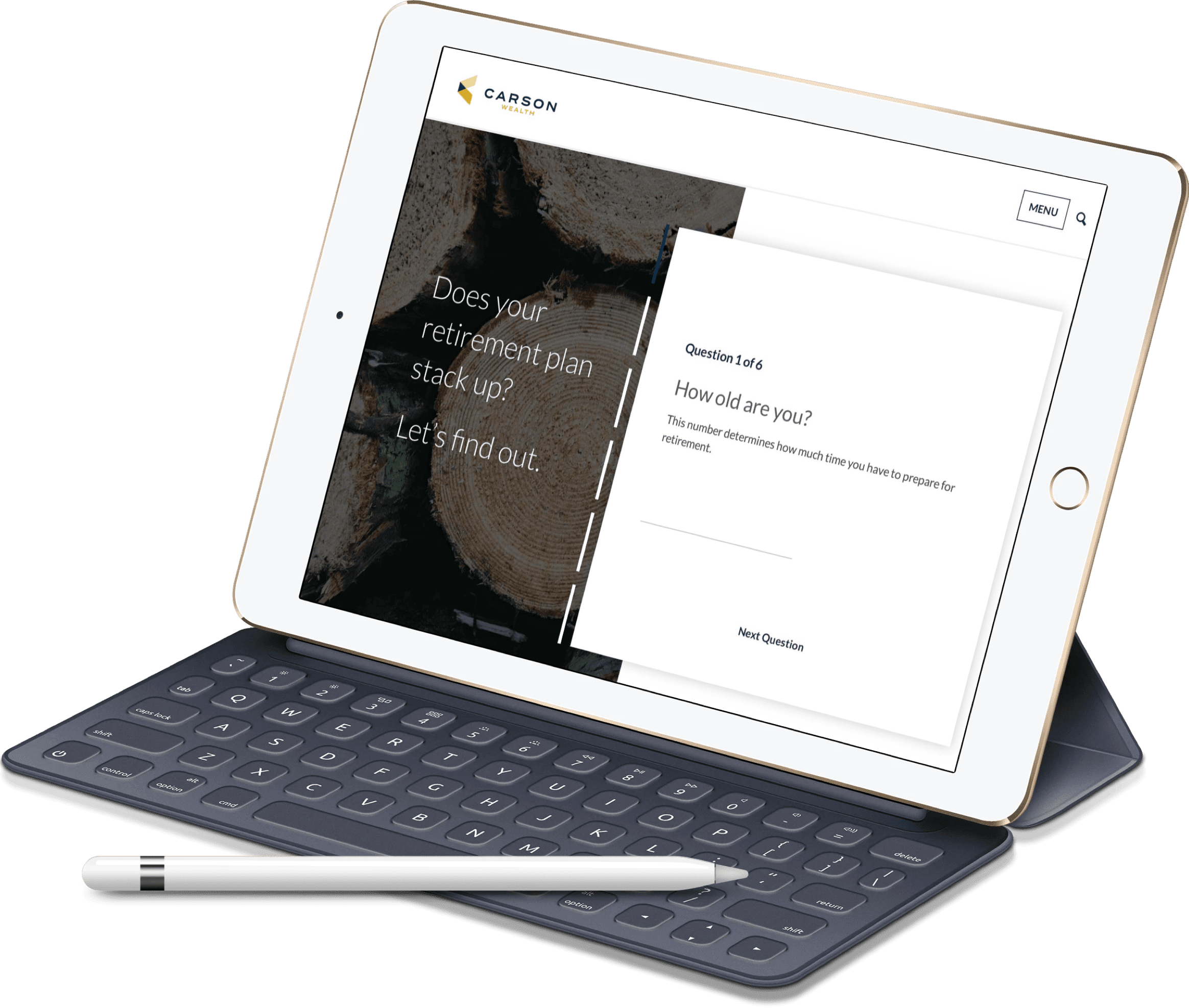

We prepare roadmaps for our clients’ “second careers” – retirement – and help them manage a tax-efficient stream of income during that time. One of our primary focuses both before and during retirement is discussing potential pitfalls along the way and how we can prepare and cope with them as they arise. There will always be issues in life, our team is ready and able to help our clients prepare for and address them.

Our team specializes in providing our clients with highly personalized, comprehensive, full-service financial planning, estate planning, tax planning, portfolio management, business planning and private client services.

BUILDING A LEGACY TO SERVE YOUR FAMILY.